How to Boost Sustainable Financing through the Different Options of Leasing and Credit Green Finance?

ARTICLE PREPARED FOR THE WORLD LEASING YEARBOOK 2023

By Amina Chakchouk, COO Leasing, and Marwa Trabelsi, Business Expert, CODIX

This is a difficult time, the world is burning, we continue to use fossil fuels as if there’s is no tomorrow. "With every day, the global energy system is increasingly driving us towards a climate catastrophe". These words were said by António Guterres, the General Secretary of the United Nations Organization, after the release of the Climate State Report 2021, which was published by the World Meteorological Organization (WMO). Also, the sanitary crisis (COVID-19) increased humanity’s awareness of the importance of sustainable development.

The only way to overcome the energy crisis is to invest in renewable energy. In Europe, the Green Deal is the best diversification outcome of the crisis. As a result, the EU continues to work to diversify its energy sources and plans on massive investments in renewable energy sources, energy efficiency and Sustainable Financing. As part of the EU’s plan for the ecological transition, the European commission aims to increase the share of renewable energies in the energy mix to 38%-40% by 2030 and to increase the obligation to save energy: For example, the EU plans to reduce the annual energy consumption, from 1.5% to 0.8%. The Russo-Ukrainian War accelerated this plan, which must unfold sooner than later.

The Green Finance includes all financial operations in favor of energy and ecological transition as well as the fight against climate change. Its main tools are the green bonds. These loans are used to finance projects contributing to the ecological transition, including management of water, waste and energy, as well as leasing and credit financing products.

In this article, we will discuss how to improve and strengthen the Leasing and Credit IT system, which in various ways can boost Sustainable Financing.

What Are the Objectives of the Green Lease and Credit Finance?

Credit institutions and insurance undertakings play a key role in the transition towards a fully sustainable and inclusive economic and financial system, in line with the European Green Deal. They can have significant positive and negative impacts via their lending, investment and underwriting activities. The objective of Leasing Green Finance is to finance the green economic activities, which significantly contribute to the achievement of environmental objectives.

The relevant six environmental objectives are:

1. Climate change mitigation

2. Climate change adaptation

3. The sustainable use and protection of water and marine resources

4. The transition to a circular economy

5. Pollution prevention and control

6. The protection and restoration of biodiversity and ecosystems

Also driven by these environmental objectives, Green Lease and Credit Finance gain major importance for financial market participants (thus, also banks and institutional investors), and companies of public interest, for whom the Taxonomy Regulation mandatorily applies. Green Lease agreements are relevant not only for financial market participants who own or rent such properties, but also for financial institutions which finance “green” activities.

What Are the Different Green Assets and Green Economic Activities?

The assets or economic activities that can be covered by Green Finance must be those included in the EU taxonomy.

The EU taxonomy is a classification system, establishing a list of environmentally sustainable economic activities. It could play an important role helping the EU scale up sustainable investment and implement the European Green Deal. The EU taxonomy would provide companies, investors and policymakers with appropriate definitions for which economic activities can be considered environmentally sustainable. In this way, it should create security for investors, protect private investors from greenwashing, help companies to become more climate-friendly, mitigate market fragmentation and help shift investments where they are most needed (cf. https://ec.europa.eu/).

The EU taxonomy provides an overview of economic activities that can make a substantial contribution to mitigate climate change:

1. Whether the contribution is based on own performance or enables improvements in other sectors

2. Whether the activity is considered as transitional

3. Which environmental goals also have "Do No Significant Harm" objectives.

Based on this classification, all reporting, risk management, provisioning, accountancy and "green” regulation are driven.

What are the different approaches of the Green Leasing Finance?

Different incentives can be used in Green Finance

- Participation in Client Rate or rate sharing, or even 0% on Ecological Assets finance

- Possibility to set up Taxes bonification or Taxes penalty based on the CO2 emission of the purchased asset

- Possibility to set up a tariff on services and insurances, based on the consumption and the CO2 emission

- Possibility to set up an extension with advantage of the use of sustainable assets

- Leasing as a service and sharing the use of sustainable assets

- Setting of seasonable pricing template for agricultural change to sustainable assets

- Special offers for real estate, adopting the ESG regulations

Hereafter, some examples of the European incentives for Green Finance:

Incentive for the development of electric vehicles

To promote the development of vehicles emitting less CO2, a bonus-penalty system is set up to reward, via a bonus, buyers of new cars emitting the least CO2, and to penalize, via a penalty, those who opt for the most polluting models.

Incentive framework to support the biomethane sector

To support the biomethane sector, an incentive framework has been put in place to encourage the use of biomethane in the transport sector (biomethane used as fuel is known as bioNGV). Under the current framework, biomethane buyers can recover guarantees of origin for the biomethane produced and benefit from a support mechanism. These guarantees of origin attest to the fact that the gas sold and injected into the network is of a renewable source. Also, these guarantees of origin are registered in a national register.

Incentive for the development of hydrogen vehicles

Hydrogen electric vehicles are part of clean mobility solutions. Complementary to battery-powered electric vehicles for certain uses, they benefit, like all electric vehicles, from the bonus-penalty system mentioned above. The development of hydrogen vehicles is still emerging and currently being at industrial deployment phase, but it has significant advantages for recharging in a short time (less than 5 minutes) and having greater autonomy than battery-powered electric vehicles. France has transposed the optional part devoted to hydrogen into the national action framework for alternative fuels and has set itself a target of 30 to 50 charging stations by 2025.

Eco-loan at zero rate (Eco-PTZ)

The Eco-PTZ is one example of incentives, introduced in 2009.

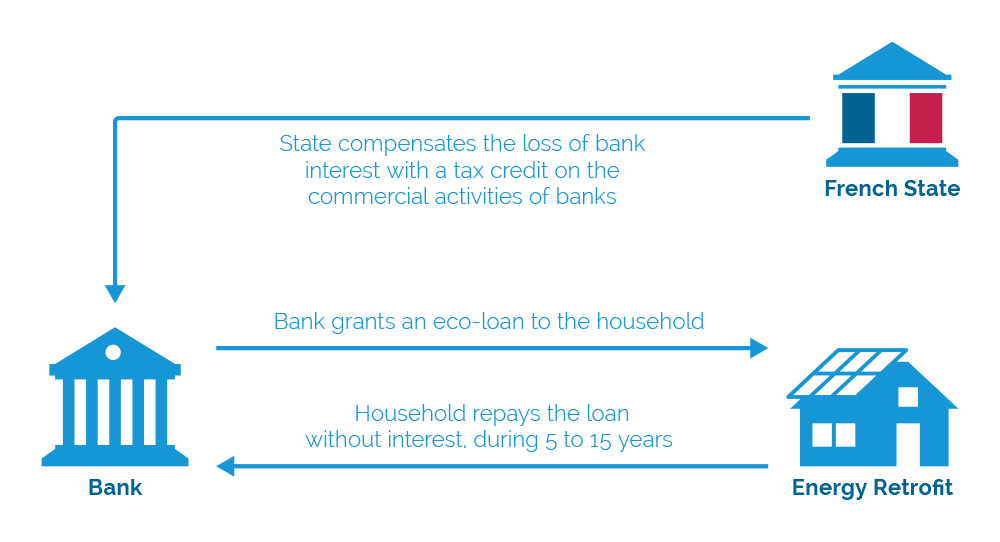

The principle allows to finance energy renovations through a zero-rate eco-loan scheme. The principle is showcased in the scheme below:

The zero-rated eco-loan scheme

Cf. The zero-rated eco-loan scheme to encourage renewable energy (ECO-PTZ)

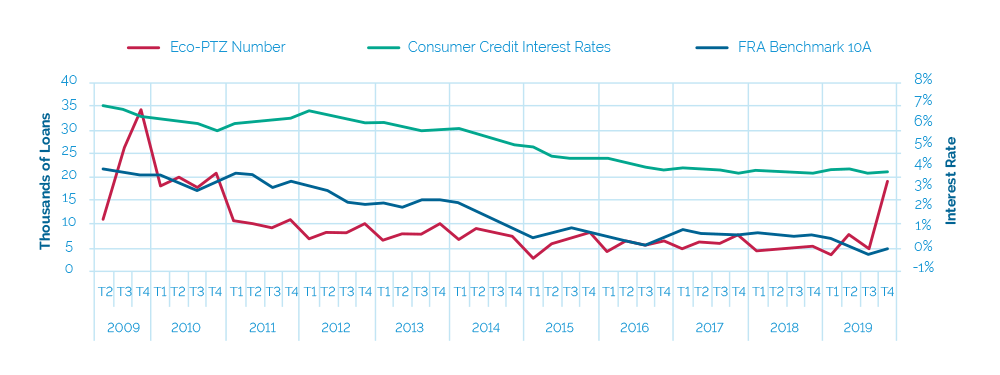

The graphic below shows the number of EPTZ loans borrowed from the beginning of this incentive. However, the borrowing rate of this type of loans is lower than expected, particularly for the period preceding the COVID-19 crisis.

Take-up of EPTZ loans

Cf. Pourquoi le recours à l’éco-prêt à taux zéro est-il si faible ?

This incentive remained rather insufficient for the past ten years, because even the borrowing ceiling could not cover the cost of Eco renovations.

For example, the cost of major renovations can easily exceed 40,000 euros. So, the barrier of 30000 is not sufficient to encourage the consumer to even begin such renovations. This example shows that when an incentive is introduced, a projection plan with real parameters should be made. Such a plan must also take into account all the costs and different opinions, and provide solutions on how to make this proposal feasible.

In conclusion, the EPTZ remains to be strengthened and extended over the next few decades. As proposed by the Citizens’ Climate Convention (2020) in France, it is imperative to remove the barriers that hinder it. The first solution which increased the borrowing rate of zero-rate eco-loans.

It is necessary to add other complementary initiatives to the Green Finance in order to attract and make efficient the Green Finance incentives, but what should they be?

As shown in the previous example of the ECO-PTZ incentives, complementary Green Finance actions must be proposed, in order to successfully proceed with the Eco Transition. There are some examples below:

The Heat Fund

The Heat Fund supports the development and the use of thermal renewable energies, including biomass (forestry, agricultural, biogas, etc.), geothermal energy (in direct use or through heat pumps), solar thermal energy, recovery as well as the development of heating networks using these energies.

The sectors concerned are: collective housing, the third sector, agriculture and industry. For these sectors, the objective of additional production of renewable heat by 2020 represents nearly 5.47 million tons of oil equivalent (toe), i.e. more than a quarter of the overall objective set for 2020 at European level within the framework of the energy-climate package (20 million toe of additional renewable energy).

Established in December 2008, the Heat Fund was set up to support the production of heat from renewable sources. It was backed by a of 1.9 billion euros package for the period 2009-2017 and enabled the support of nearly 4,300 operations, which generated an investment amount of €5.8 billion and a production of 25TWh/year.

General Tax on Polluting Activities (TGAP) and Biofuels

The TGAP encourages the incorporation and distribution of biofuels by penalizing operators who release a proportion of biofuels below the set threshold for consumption. The TGAP rate was set at 7% in energy for the diesel and petrol sectors for 2010. Since 2014, this rate has been increased to 7.7% for the diesel sector and maintained at 7% for the petrol sector.

How do the European enterprises measure the share of their financing allocated to sustainable economic activities?

Following the Paris Agreements from 2015 and in response to the action plan launched by the European Commission in 2018, the European Banking Authority calls on credit institutions to put in place key performance indicators, entitled « Green Asset Ratio » (GAR), so that the institutions can measure the share of their funding allocated to sustainable economic activities. It is a performance indicator, measuring the share of their banking portfolio associated with environmentally friendly economic activities.

This GAR is a fraction, composed as follows:

The numerator shows the proportion of assets on the balance sheet of financial institutions, which is invested in 'green' economic activities and thus, aligned with the European taxonomy as:

- Credits

- Bonds

- Equities

- Collaterals included on the basis of 'green' economic assets in the European Taxonomy, based on KPI indicators of both investment in fixed assets or Capex, and turnover of underlying assets.

Excluded from the numerator of the ratio, however, are:

- All financial-type assets held for trading purposes

- 'On-demand' interbank loans

- Assets excluded from the scope provided by the Non-Financial Reporting Directive (NFRD), i.e., those loans to SMEs that are outside the scope of the NFRD and therefore, do not publish information on their alignment with the European green taxonomy and for which, as mentioned above, the BTAR will be calculated

- Non-EU exposures and also, hedging derivatives.

The denominator of the Ratio, on the other hand, contains:

- The financial institution's total assets

- Total loans

- Total bonds and equities in the portfolio

- Total collateral recovered

- The other assets in the balance sheet.

The calculation takes into account the main instruments in the assets of the banking book (i.e., loans and non-sovereign bonds and equity securities), excluding assets held for trading purposes, due to their volatility, as well as sovereign securities.

The calculation and publication of the GAR by the major European banks is part of the extra-financial reports (dedicated in particular to the fight against climate change), which large organizations must provide since 2018 under the Directive on extra-financial information (NFRD – Non-Financial Reporting Directive).

Calculating this new ratio represents a serious challenge for credit institutions. To do this, financial organizations must have reliable information systems, which allow them to generate this kind of detailed report based on a detailed classification (by type and sub-type of asset rather than sector of activity).

Cf. ANNEX XXXVIII – Instructions for Disclosure of ESG Risks

Risk Management in Green Finance

In order to manage the climate change risk, a list of disclosure reports is requested by the ESG regulation. A list of reports and annexes is required from the bank institutions. These reports and annexes are mainly based on the classification of the assets by the Taxonomy and the Ecological activities finances and calculate in detail the different risk KPIs. Here below are the main ones:

Qualitative information on Environmental risk, on Social Risk and Governance Risk

In application of Article 449a, in conjunction with Article 435 of CRR, Bank institutions should disclose information on their exposures towards non-financial corporates operating in carbon-related sectors, and on the quality of those exposures, including non-performing status, stage 2 classification in IFRS9, and related provisions as well as maturity buckets.

Institutions should apply qualitative Information on Social risk on their 5-business strategy and processes, governance and risk management.

Institutions should also apply qualitative information on Governance risk, in order to describe the integration of such a risk in the overall governance and risk management policy.

Quality of exposures by sector, maturity buckets and GAR KPI

Following Article 449a CRR, large institutions with securities traded in an EU regulated market shall disclose information on ESG risks, including Physical risks and Transition risks, as defined in the report referred to in Article 98(8) of Directive 2013/36/EU.

Conclusion

In the current political and economic context of Europe and the world in general, as well as the urgent need for a transition to clean Energy, Taxonomies can play an important role in the architecture of countries’ financial systems, if properly and appropriately designed.

It is important to remove all the boundaries to access the different incentives in order to accelerate the transition to Green Finance. Therein the IT system plays a central role in this transition, by easily managing all related processes and regulation rules. The IT leasing/loan software should be enough powerful and flexible, comprising:

- An Asset and collateral parametrization module and different classification levels, in order to set up all the necessary information required by any regulation.

- A robust IRR calculation tool and flexible and accessible financial calculation module, in order to set every type of incentive, flexible payment schedules, guarantees, commissions, bonifications, GAR integrated.

- A robust scoring module with multiple types of scoring that can easily be set up, taking into account different risk management in Taxonomy.

- A fully parameterized process to make fully automatic as many processes as possible, with easily managed criteria on Taxonomy Matrix in all the processes and calculations.

- An integrated risk management module to be able to calculate in real time the risk staging and to take into account the IFRS9 impact changes in the ESG regulation.

- Intelligent risk modelling, using AI to include easily different scenarios in the PD, ECL calculation and GAR calculation.

Fortunately, such software packages exist, such as, for example – iMX Leasing and Credit. Such technological solutions can be of immense benefit in а world of constant change, especially the ones which are constantly acquiring richer and stronger features thanks to the sustained investment over the years by their respective editors. We do encourage you to explore how the iMX Leasing and Credit solution can address the issues described in this article, in the specific context of your company and the challenges it faces.

References:

https://fincley.com/

https://www.ecologie.gouv.fr/

https://www.eba.europa.eu

This article was published also by NEFA (The National Equipment Finance Association).