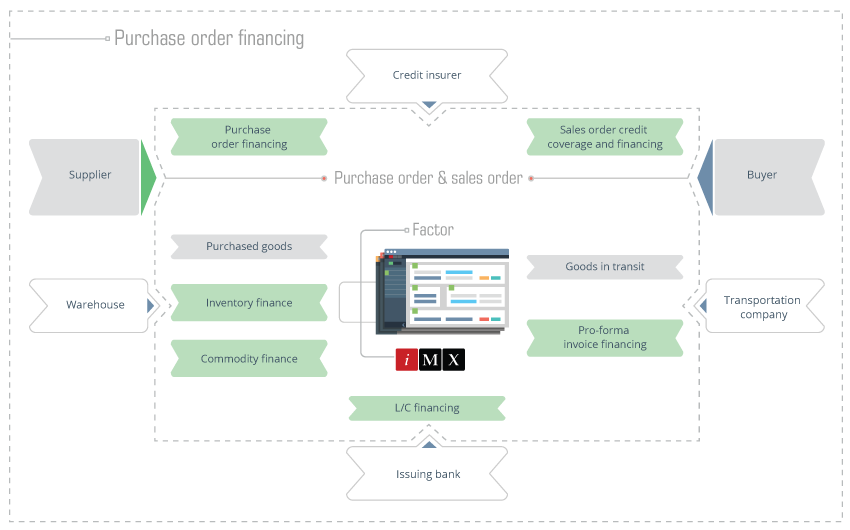

Purchase Order Financing

Purchase Order Financing is known on the market also as Pre-shipment finance, Packing finance, Packing credit or Contract monetization financing. As a working capital finance solution, the pre-shipment finance enables the supplier to purchase raw materials for production or goods and to cover all the expenses in order to fulfill the delivery to its buyers. Purchase order financing can also be applied to services.

Pre-shipment finance in iMX

In the world of pre-shipment finance, iMX supports all possible products:

- Inventory finance is usually provided to the supplier in order to purchase products for sale when he cannot negotiate higher credit terms from his vendors. The inventory, which is bought with the funding, usually serves as collateral. As there is an automatic process for integration of the inventory items in iMX, the monitoring and the control are improved significantly for the client.

- Commodity finance as a financing technique is mainly orientated towards producers and trading companies of soft commodities (agricultural crops) and hard commodities (raw materials e.g. minerals, metals, etc.). With the iMX software solution, an effective liquidity management for the financing process from the production/ purchase to the sale of the commodities can be performed. Furthermore, the risk is mitigated by the option for a market value appraisal of the commodities, based on the latest market information from an external provider.

- Pro-forma invoice financing is a form of supplier financing, where payment is sent directly to the supplier upon the buyer’s request and is calculated as a certain percent of the value of the shipment for the inventory in transit. The financing is based on certain documents and information, provided from the transportation company and in addition the buyer needs to cover part of the shipment’s value. The significant advantage in iMX is that based on shipment progress, there is an evolution of financing.

- Purchase Order Financing can be provided to the seller against purchase order, issued by a reputable buyer. In order to be financed, the purchase order is important to reflect the latest agreement between the parties. From the initial purchase order in iMX, an effective management is performed at each stage of the trade transaction based on which the funding is authorized.

- Sales order credit coverage and financing – The sales order as a document is issued by the supplier and is sent to the buyer for confirmation of the sale before delivery. The financing is usually granted to the supplier based on the prior approved credit limit. The information integrated process in iMX allows all the information for the trade documentation to be linked (purchase/sales order, transport documents e.g. bill of lading, CMR, airway bill, certificate of origin, insurance, etc.).

- L/C financing is based on a documentary or standby letter of credit, issued on behalf of the buyer and in favour of the seller. Often the L/C conditions are included in the purchase order. In addition to the ability of the seller to perform under the contract with the buyer, the irrevocable undertaking by the issuing bank to pay to the beneficiary of the letter of credit is essential for structuring the pre-shipment financing.

The strong points of iMX for these products are:

- Electronic data files uploads with the iMX Extranet (web portal) flexible file mapping engine

- Real-time calculation of the fundable amount per transaction, costs, etc.

- Possibility to have these collaterals as part of multi-collateral accounts/facilities

- Integration with credit insurers and the entire iMX risk management module

- Standalone products or linked together to follow the physical transformation and movements of the underlying assets (for more details, please consult the page iMX for Supply Chain Finance)

- Possibility to handle these contracts with funding partners, as club deals/syndication

It is worth highlighting here the importance of the iMX Analysis and Decision module for the operational and statistical reporting on PO financing activities, from pre-sales to aftercare.

To learn more about iMX Commercial Finance, download our brochures: Commercial finance (Factoring) – Main functionalities in iMX, Accounts Receivable Financing in iMX, Extranet for Commercial finance in iMX, and iMX Analysis & Decision (Factoring).