Asset-Based Lending

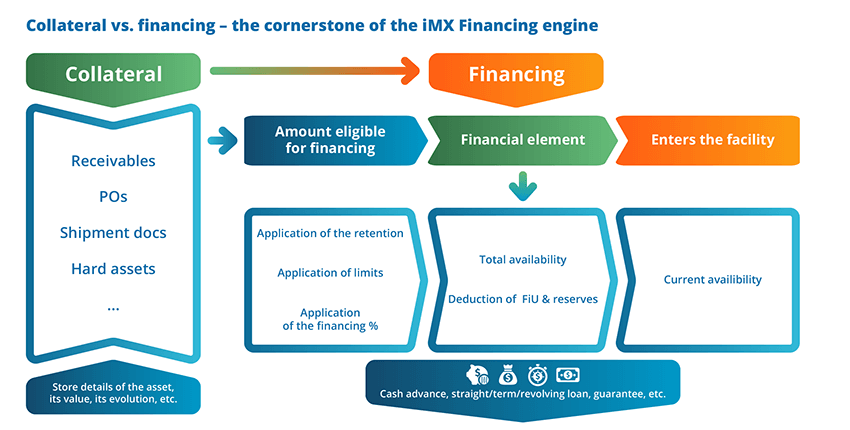

iMX is a the premium software system for managing Asset-Based Lending (ABL). Thanks to its smart financing engine, represented here below, iMX actually supports any type of collateral as an underlying value of the funding provided to suppliers:- Funding by asset category in distinct Client Accounts, or assets from multiple categories grouped together in the same Client Account, especially Inventory and Receivables, thus covering all ABL facilities typically proposed on the market.

- For receivables in the ABL facility, borrowing base certificates can be entered as such or computed by the system based on the sales ledger submitted by the Client.

- Plant, Machinery and Equipment and Real Estate financing are, of course, also part of the portfolio of the ABL products iMX supports, either independently or as part of multi-asset ABL contracts.

- Possibility to share or participate in the financing burden and risk with funding partners in case of syndicated deals.

- The whole power of the iMX rich features set is available for ABL.

ABL in iMX

There is just no limitation to the nature of the asset which can be captured in iMX and used as collateral for financing activities. iMX has the necessary business processes in place to track and follow the evolution of the nature and value of the asset and trigger alerts when that value reaches a high risk level when compared to the funding already granted based on this asset.

iMX also offers the capability to cap the funding secured by collateral of a given category in the contract based on the fundable value of another category of assets (expressed as a percentage or amount), thus giving creditors full control over the actual evolution of the facility.

It is worth highlighting here the importance of the “iMX Analysis and Decision” module for the operational and statistical reporting on ABL activities, from pre-sales to aftercare.

For more information about iMX Commercial Finance, download our brochures:

iMX Commercial Finance, iMX Commercial Finance Extranet and iMX Analysis and Decisions – Commercial Finance.