Supply Chain Finance and Reverse factoring in iMX

Supply Chain Finance (or Reverse factoring) is surely the product with the greatest number of names on the market (supply chain financing, reverse factoring, payables financing, buyer centric funding, confirming, forfeiting) incorporating many flavours and variations. iMX is able to support them thanks to advanced parameters at creditor level and contract level.

All business processes for reverse factoring are handled in iMX in a very similar way as for traditional factoring, allowing users to work comfortably on both products, and thus leveraging their experience acquired on one of these products and applying it to the other one.

How iMX supports Reverse factoring and its life-cycle

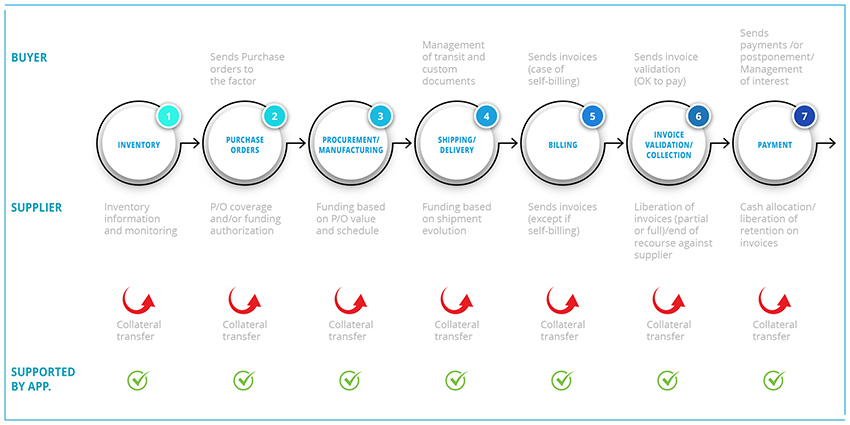

Reverse factoring in iMX Commercial Finance can then be used either independently or as part of the commercial finance products suite in iMX. As with other products, the entire life-cycle of a reverse factoring contract is supported by iMX:

- Several flavours of supplier onboarding, from totally automated onboarding (systematic onboarding of the buyer’s suppliers) to KYC-based suppliers onboarding with interaction over the iMX Extranet web portal

- Receivables handled either in a globalized approach similar to traditional factoring or on an “invoice-by-invoice” basis

- Supports Forfeiting and Confirming

- Contracts can be limited to receivables or be open to Purchase Orders as well

- Extensive possibilities/parameters concerning predefined interest, costs and fees, including profit sharing paid back to the buyer in additional payment days or in actual money

- Cash application facilitated by payment notice (payment announcement) integration and reconciliation

- Possibility to manage these contracts with funding partners, as club deals/syndication

And of course, the entire range of the iMX rich features set is available for Reverse Factoring activities.

It is also worth highlighting here the importance of the iMX Analysis and Decision module for the operational and statistical reporting on reverse factoring activities, from pre-sales to dunning.

Pre-shipment and Post-shipment financing products

iMX handles all the pre-shipment and post-shipment financing products as stand-alone products and some 13 years ago we added to iMX the “N-to-N” linking mechanism between order form, transport document and invoices. The mechanism follows the real physical transformation and the movement (dispatch) of assets within the application; as a consequence, it has an impact on the financing availability.

- Transformation of items in the inventory to include them in a purchase order

- Shipping of one or more purchase/sales order(s) (PO) via one or more shipment document(s) (Bill of Lading, BoL)

- Receipt of invoices and linking them to one or more BoL(s) and/or PO(s)

- Updating the order and/or shipment status based on information received from the supplier and/or shipping company

- Electronic upload via files or online messages of all the document data and updates

- Applying different financing rates based on inventory details, the PO/BoL status and their evolution in time

- And much more…

It is worth highlighting here the importance of the iMX Analysis and Decision module for the operational and statistical reporting on supply chain financing activities, from pre-sales to aftercare.

For more information about iMX Commercial Finance, download our brochures: iMX Commercial Finance, iMX Commercial Finance Extranet and iMX Analysis and Decisions – Commercial Finance.