Pay-Per-Use: The Challenges For Consumption-Based Leasing In A Tech-Driven World

Article Written For The World Leasing Yearbook 2020

By Kameliya Slavchova and Denis Georgiev, iMX Application and Business Experts, CODIX

The advancement of technology in recent years has opened the door to many alternative business models which were previously thought impractical or even impossible. For instance, innovation has changed the automotive industry, financial trading and banking, engineering, mechanics, architecture, medical equipment, sports, etc. Businesses are keen on embracing innovation so as to stay ahead of the curve, and respectively people’s expectations change as more and more aspects of their lives become digitalised and automated. Not surprisingly, we continue to witness the emergence and success of a variety of creative business ideas.

The leasing industry is of crucial importance for the modern leasing model. It helps meet the user’s growing needs and requirements. But it also faces some challenges, such as the increasing digitalisation and innovation of financial lease products, accommodating the specifics of circular leasing, and some sustainability issues.

In response to those changes and pressing questions and demands, the leasing world needs innovative and flexible software packages which are able to evolve fast and adapt at a high pace.

CODIX has developed its cutting-edge leasing solution to address those challenges and has focused its research on new solutions dealing with a new type of service. In this article we will aim to shed some light on the provision of ‘pay-peruse’ services. This type of service provides a great deal of convenience to end customers: it allows them to avoid spending unutilised capital by paying only for what they have consumed. As far as under-utilised assets are concerned, it may come out cheaper for customers when compared with conventional leasing. Therefore, there is undoubtedly room in the market for this type of service.

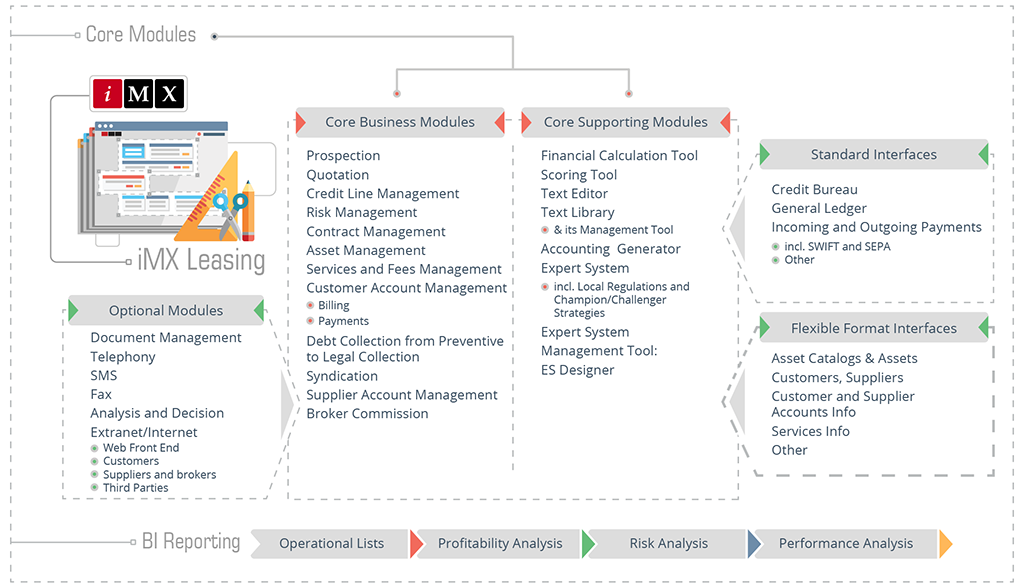

Table 1: Core modules of iMX

Although this service may seem useful from the end-customer’s perspective, it does not come without its challenges. Here are some examples of the hurdles that lessors need to overcome:

- The need to offer service tariff catalogues based on asset consumption with a multi-dimensional matrix.

- The need for proper tracking, real-time updates and processing of service tariffs with connected devices through APIs.

- The need to make multi-step leasing offers (different ranges of rents) at different appropriate intervals depending on asset consumption.

- The need to base scoring models on user consumption and measure the risk.

- The need to compile AI information properly and use it in order to build new scoring models.

- Asset depreciation and real-time asset valuation.

- The unpredictability of asset usage and automatic maintenance prevention.

- The need to comply with regulatory changes on a continuous basis.

- The necessity to remain up to date and customer-friendly with an easy interface with multi-channel applications.

- The necessity to control the risk and optimise profitability.

- Repackaging assets and re-marketing or re-utilising any returned assets.

It is generally believed that cheaper and mobile assets are more suitable for pay-per-use leasing, but this is not always true. Many large and stationary assets are leased based on consumption (e.g. medical, construction, and agricultural equipment). The market for such assets may be considered rather niche.

Generally, lessors should strive to diversify their asset portfolio in order to control the risk and maintain profitability. This could mean avoiding too much focus on one particular asset category. However, since more expensive assets have a higher barrier to entry and often have a niche market, lessors tend to specialise in a single field.

Furthermore, more expensive assets with a narrow potential market could make a lessor highly dependent upon their lessee, leading to some loss of control over the price or the terms of the lease. On the other hand, familiarity with such niche markets would be a significant advantage for a lessor over the competition.

However, let us narrow down our focus on the short-term leasing of mobile, less expensive, more liquid assets, for which the target clientele are end users.

Let us consider an example involving renting a vehicle based on the mileage used by the customer. To make this service attractive, it should be easy to: locate the vehicle, get approval, hire, track the usage, know the cost (or estimated cost), return the vehicle, receive assistance and information.

Fortunately, nowadays there are technologies that allow all this to happen by providing flexibility and thoroughness.

With the widespread availability of GPS and smart phones, locating the vehicle should be considered a natural pre-requisite which the lessor ought to provide to customers.

As regards the issue of getting approval, vetting customers is important to any lessor. In the current business climate, it is crucial that the approval be carried out very quickly. Of course, speed should not be at the expense of the risk management process. To achieve a good balance, lessors need to have a sophisticated scoring procedure in place with pre-defined rules and criteria supported by back-end programs for external communication with governmental and credit institutions, so they can extract up-todate personal and credit information. Afterwards, ideally a decision-making tool can be used for automatic approval or rejection along with pre-set criteria for manual review.

In this particular example, a positive factor is that the offered vehicles (such as electric cars or scooters) are often innovative, eco-friendly and thus they are very likely to be exempt from taxes, which provides an economic advantage to the lessor obliged to bear these costs and charge the customer an “all-inclusive” rate.

In addition, given how popular the issue of sustainability has become, customers are very likely to have the incentive to use such vehicles. In that regard, lessors need to look for a way to optimise the process by sending alerts to customers regarding the impact on taxation. The service can be furthered by sending messages regarding any applicable fees (e.g. central city zones fees, paid parking fees) depending on the current location of the customer or the level of usage of the asset.

Moreover, when an agreement is reached to hire the asset, contract management itself can be electronic via web services and e-signature platforms for the sake of convenience and transparency. Automatic emails and message confirmations should be distributed to customers and other stakeholders, such as brokers, partners, etc.

Usage tracking could be performed through GPS and the realtime information available to the lessor and the customer (via web platforms, mobile applications, and automatic consumption alerts). For other types of assets, tracking may involve periodic metering (as with utility bills), Internet usage (mobile data or internet service providers), data storage (servers), paper printing (IT equipment), etc.

From an economic perspective, pay-per-use lessors face the challenge of having to predict the usage of assets in order to set their price accordingly. This is because with consumption-based leasing, it is difficult to predict what portion of the fixed expenses such as tax, insurance and asset depreciation should be allocated to every customer. And here comes another question: how can a lessor prevent an asset not being used sufficiently to cover its own fixed expenses?

One possible approach would be to introduce a matrix system of charging or minimum spending (for example, minimum per day) in order to make up for any deficit in usage. Another option may be to employ a ‘subscription plus usage’ model, whereby the customer is charged a fixed fee when they agree to use the asset, and an additional fee depending on the usage (e.g. a rate per mile). However, it must be a balancing exercise, as lessors must strive to keep prices on the market as competitive as possible. In any event, lessors ought to have a policy of sending automatic consumption messages to customers.

Besides, lessors should possess an accurate and reliable system of data reporting and analysis. Since each business is different, reports must be flexible and customisable to be able to capture the relevant information. Along this line, it is quite useful to devise back-end programs to manage usage data in real time and update matrix allocation and pricing based on predefined criteria.

Another point to consider for pay-per-use leasing of mobile assets is that the asset is often not returned at the property or in the presence of the lessor. For instance, returning a short-term hired electric car consists of parking the car at an allowed location and leaving it there. In such cases it is advisable to have well-defined rules about where and how an asset may be left to prevent unnecessary risks of damage after the leasing contract ends and any fines or penalties (e.g. unlawful parking).

Furthermore, the lessor should be careful to protect themselves contractually and ensure they are indemnified if an undue cost occurs. It would also be reasonable for the lessor to carry out periodic physical inspections of the assets, as well as to have automatic email or message confirmations (along with any invoicing) sent to customers and other involved parties.

In addition, the lessor should be able to re-calculate the value of the asset (or its depreciation) and, if necessary, re-calculate the amortisation table at the end of the lease period. This can be managed in different ways, and the process can be automated and sped up by modern back-end programs working with up-to-date information.

Another interesting issue to consider is that pay-per-use leasing is generally not compatible with the provision of a financial lease. This is because, since the end customer only pays for the usage, they are unable to contribute towards the principal amount of the asset as is the case with financial leasing. This would not prevent a lessor from providing both types of services.

Furthermore, providers of conventional leasing often face the challenge of re-marketing or re-using any returned assets following a period of leasing (“secondary market”). Many choose to sell the asset while others are more likely to lease the asset again.

In this context, it is of note that if the potential market for an asset is a niche market, the asset has lower liquidity and presents a greater risk of non-usage and therefore a loss in capital. This should be taken into account in the risk assessment of the asset. Here again, if the lessor has the correct system in place, pay-per-use could be an opportunity for re-using a returned asset, thus reducing un-utilised assets and improving profitability.

Clearly, an important issue for any leasing services provider is invoicing and payment management. Since in pay-per-use the invoicing is linked to the usage, there must be accurate and swift communication between the usage-tracking system and the system for the generation of invoices. All these processes should be as automated as possible in order to achieve quickness and maintain accuracy.

Furthermore, in case of a short-term and easy-access leasing, the lessee is often willing to pay, especially smaller amounts, almost immediately. In turn, the lessor must ensure that suitable solutions are available for quick and secure electronic payment, via a mobile device, debit and credit cards, and possibly online payment platforms. The lessor’s software must include a set of rules and programs for managing business processes automatically and updating data in real time, along with a web service or mobile application with up-to-date information regarding consumption and account management in order to facilitate payment and feedback.

Last but not least, user-friendliness of the system is a must. If nothing else, then from a user’s point of view, it is extremely important to ensure a smooth and reliable journey for the end user. With smart phones, people have the world at their fingertips, and it only makes sense for this type of service to be accessible through mobile devices. The lessor’s system has to provide flexibility which may mean different pricings or payment options, pricing estimations, replacements of assets, discount matrices or other mechanisms to encourage and promote increased usage, loyalty or referrals, choice of assets, advance booking, etc. What is more, a software solution may be advantageous if it is compatible with popular related products such as Google maps or PayPal.

In the context of user-friendliness and brand promotion, the lessor can benefit from the usage of data and the re-engaging of customers by suitably communicating (via messages or calls) any information about attractive offers or discounts. Renewal invitations can be sent in the same way, or by managing a membership system. That is why it is vital for each organisation to possess an internal alert system allowing the lessor’s employees to contact potential or returning customers.

Looking further ahead, we may witness, in the near future, the use of voice commands, fingerprint or facial recognition, breathalyzer tests and many other technological ideas making their way through the business world, including the world of leasing. Despite the challenges facing pay-per-use lessors, this market is developing and it is a good opportunity for growth.

In any case, it is clear that organisations in this field which want to remain competitive and stable must have a robust and flexible software solution to address the challenges of the business and any needs a customer may have.

Published in: World Leasing Yearbook, Dec 06, 2019